Unlock the Secrets of Effective Company Bookkeeping

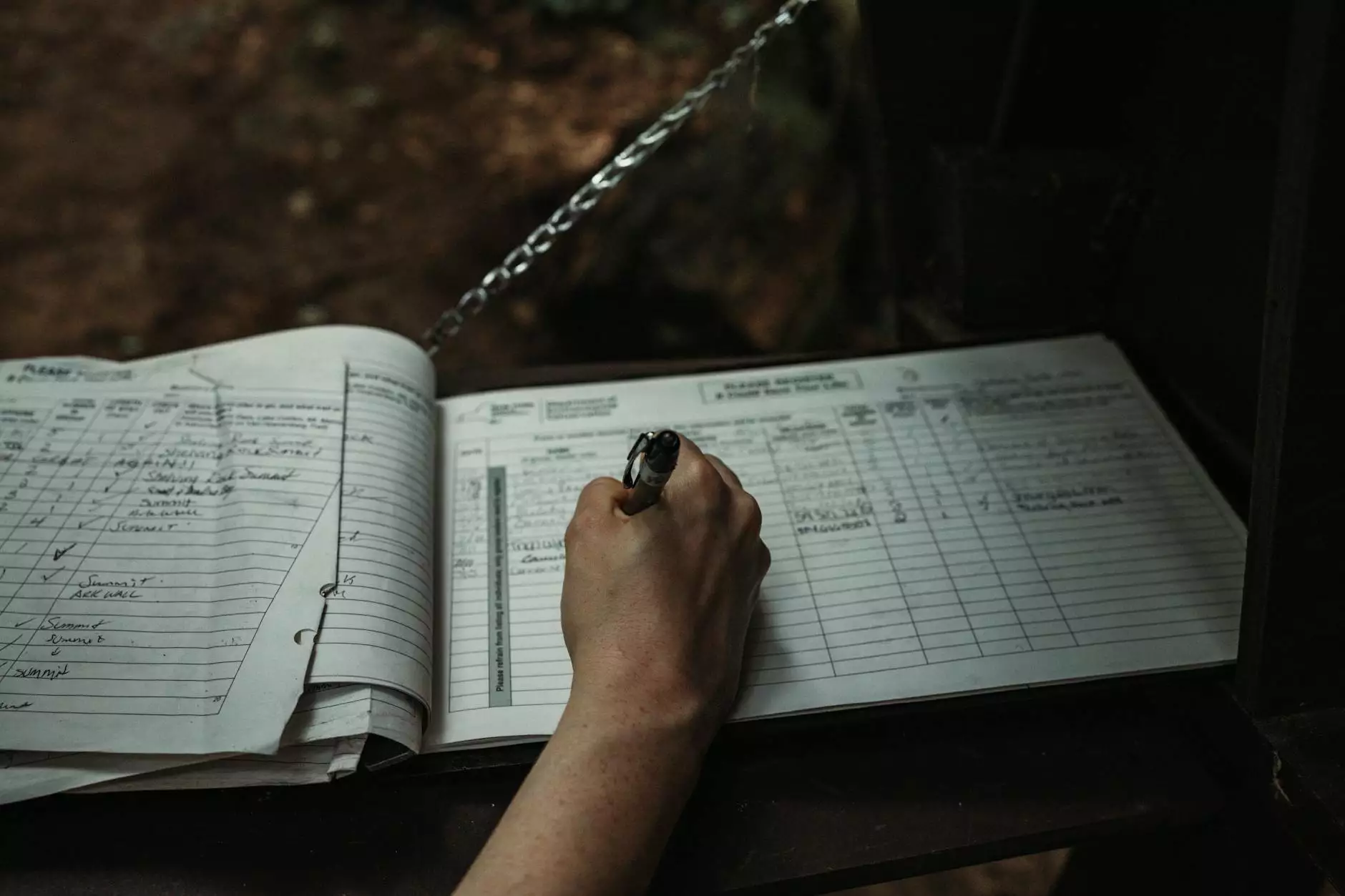

Introduction to Company Bookkeeping

Company bookkeeping is an essential component of any successful business. It serves as the foundation for financial transparency, enabling companies to make informed decisions. In this article, we will delve into the intricacies of bookkeeping, explore its significance, and provide actionable insights to optimize your financial management practices.

Understanding the Basics of Bookkeeping

At its core, bookkeeping involves the systematic recording, reporting, and analysis of financial transactions. It encompasses various processes that ensure accurate financial data management, benefiting all types of businesses, from startups to established enterprises.

Key Aspects of Bookkeeping

- Transaction Recording: Documenting all financial transactions through sales, purchases, and receipts.

- Account Reconciliation: Ensuring that financial records match with statements from banks and suppliers.

- Financial Reporting: Generating reports that summarize the financial status, including balance sheets and profit and loss statements.

- Tax Compliance: Preparing necessary documents for tax filings to meet legal obligations.

The Importance of Company Bookkeeping

Proper bookkeeping is crucial for numerous reasons. It serves as the backbone of financial health and offers insights into the company’s operations.

Benefits of Proper Bookkeeping

- Informed Decision Making: Accurate financial records provide vital insights necessary for strategic decision-making.

- Enhanced Financial Control: Companies can identify cash flow trends and monitor income and expenses efficiently.

- Regulatory Compliance: Staying compliant with tax regulations and financial laws prevents legal issues.

- Investor Confidence: Transparent financial practices foster trust among stakeholders and potential investors.

Common Bookkeeping Methods for Companies

There are various methods companies can adopt for bookkeeping, each with its unique advantages depending on the business structure and requirements.

Single-Entry vs. Double-Entry Bookkeeping

The two most prevalent bookkeeping methods are single-entry and double-entry bookkeeping.

Single-Entry Bookkeeping

This method is simpler and primarily used by small businesses. It records each transaction in a single account. While it is easier to manage, it may lack the depth of financial analysis provided by the double-entry system.

Double-Entry Bookkeeping

In contrast, double-entry bookkeeping records each transaction in at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. This method minimizes errors and provides a comprehensive view of the financial state of the business.

Choosing the Right Bookkeeping System

Selecting an appropriate bookkeeping system is pivotal for any business. With various options available, companies must assess their needs thoroughly.

Factors to Consider

- Business Size: Larger companies may require more sophisticated systems to handle higher transaction volumes.

- Industry Requirements: Specific industries may have unique bookkeeping needs influenced by compliance and regulatory practices.

- Software Integration: Ensuring that the bookkeeping system integrates seamlessly with other software used in the business is essential for efficiency.

- Cost Considerations: Budget constraints should guide the selection process, balancing features and affordability.

Implementing Technology in Bookkeeping

With advancements in technology, businesses now have access to various tools that streamline the company bookkeeping process. Automated systems can save time and reduce errors.

Benefits of Bookkeeping Software

- Automation: Many software solutions automate repetitive tasks like invoicing and reconciliations.

- Real-Time Data: Access to real-time financial data enables businesses to make quicker decisions.

- Data Security: Robust security measures protect sensitive financial information from unauthorized access.

- Scalability: As a business grows, these systems can scale to accommodate increased complexity in bookkeeping needs.

Hiring Professional Bookkeepers

For many businesses, hiring professional bookkeepers or accounting firms can be invaluable. These experts bring extensive knowledge and experience, ensuring that financial records are impeccably managed.

Advantages of Professional Assistance

- Expertise: Professional bookkeepers possess specialized skills in financial management, tax laws, and compliance.

- Time-Saving: Outsourcing bookkeeping allows business owners to focus on core operations instead of getting bogged down in financial details.

- Strategic Insights: Experienced professionals can provide insights that could improve profitability and reduce costs.

- Reduced Risk: Hiring experts minimizes the risk of financial errors that could lead to penalties or discrepancies.

Maintaining Accurate Bookkeeping Records

Regardless of whether you choose to handle bookkeeping in-house or outsource it, maintaining accurate records is essential. Here are some best practices to follow:

Best Practices for Effective Bookkeeping

- Consistent Record-Keeping: Establish a routine for entering transactions to avoid backlogs.

- Regular Reconciliation: Frequently reconcile accounts to ensure accuracy and catch errors early.

- Organized Documentation: Keep all financial documents organized and easily accessible, including receipts and invoices.

- Periodic Reviews: Conduct regular reviews of financial statements to assess company performance and areas for improvement.

Conclusion: The Future of Company Bookkeeping

As businesses continue to evolve in a rapidly changing economy, company bookkeeping will remain a critical function that shapes a company’s success. By adopting modern tools, best practices, and possibly even professional assistance, businesses can achieve greater financial clarity and control.

In the end, effective bookkeeping not only ensures compliance and financial stability but also transforms your business into a more viable entity, prepared to seize new opportunities as they arise. By prioritizing company bookkeeping, you are not just managing your finances; you are empowering your business to prosper in dynamic market conditions.